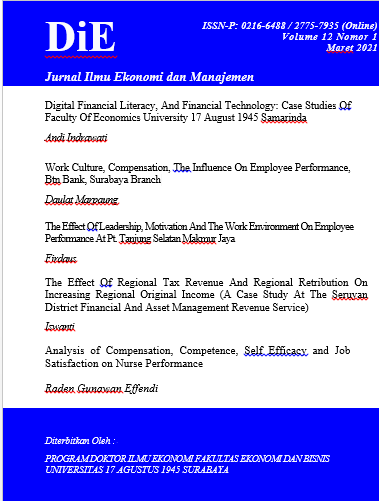

DIGITAL FINANCIAL LITERACY, AND FINANCIAL TECHNOLOGY: CASE STUDIES OF FACULTY OF ECONOMICS UNIVERSITY 17 AUGUST 1945 SAMARINDA

DOI:

https://doi.org/10.30996/die.v12i1.5102Keywords:

Financial Literacy, Financial Behavior, Purchase Interest in Financial Technology ProductsAbstract

This research was conducted with the aim of knowing how much the level of

financial literacy in students of Economics, University of 17 August 1945

Samarinda, and the authors wanted to know whether there was an influence of the

level of financial literacy on interest in using Financial Technology products. This

type of research is descriptive quantitative research using probability random

sampling techniques with student respondents majoring in management

accounting study program. In this study, the data analysis used was descriptive

analysis and multiple regression analysis using JASP. The results of this study

indicate that (1) the level of digital financial literacy has a significant effect on

buying interest in financial technology products, (2) which indicates that financial

behavior has no significant effect on buying interest. in financial technology

products.

Keywords : Financial Literacy, Financial Behavior, Purchase Interest in Financial

Technology Products

Downloads

References

Adiwijaya, D., Sapto, P.R., Sutikno, Sugeng, E., & Subiyanto. 2003. Budidaya udang vaname (Litopenaeus vannamei) sistem tertutup yang ramah lingkungan. Departemen Kelautan dan Perikanan. Balai Besar Pengembangan Budidaya Air Payau Jepara, 29 hlm.

Anonim. 2003. Litopenaeus vannamei sebagai alternatif budidaya udang saat ini. PT Central Proteinaprima (Charoen Pokphand Group) Surabaya, 16 hlm.

Dahuri, R., J. Rais., S.P. Ginting dan M.J. Sitepu. 2001. Pengelolaan Sumber Daya Wilayah Pesisir dan Lautan Secara Terpadu. PT Pradnya Paramita. Jakarta.

Mangampa, M. & Mustafa, A. 1992. Penggunaan benur hasil pembantutan dan pengelolaan ransum pada budidaya udang windu, Penaeus monodon yang dibantut. J. Pen. Budidaya Pantai, 8(1): 37-40.

Mangampa, M. & Hendrajat, E. 2008. Optimalisasi padat tebar udang vanamei (Litopenaeus vannamei) pada pentokolan sistim hapa. Prosiding Pusat Riset Perikanan Budidaya, 8 hlm.

Mangampa, M., Tahe, S., & Suwoyo, H.S. 2009. Riset budidaya udang vanamei tradisional plus menggunakan benih tokolan dengan ukuran yang berbeda. Konferensi Akuakultur Indonesia 2009. MAI, Yogyakarta, 11 hlm.

Mustafa, A. & Mangampa, M. 1990. Usaha budidaya udang tambak menggunakan benur windu, Penaeus monodon yang berbeda lama pembantutannya. J. Penel. Budidaya Pantai, 6(2): 35-46.

Poernomo, A. 2004. Teknologi Probiotik Untuk Mengatasi Permasalahan Tambak udang dan Lingkungan Budidaya. Makalah disampaikan pada Simposium Nasional Pengembangan Ilmu dan Inovasi Teknologi dalam Budidaya. Semarang , 27-29 Januari. 2004, 24 hlm.

Suprapto. 2005. Petunjuk teknis budidaya udang vaname (Litopenaeus vannamei), CV Biotirta. Bandar Lampung, 25 hlm.

(2016). "Development of a

financial literacy model for

university students,"

Management Research Review,

Emerald Group Publishing, vol.

(3), pages 356-376, March.

Asandimitra, N., & Kautsar, A.

(2020). The Influence of

Financial Information, Financial

Literacy, Financial Self-Efficacy,

and Emotional Intelligence to

Financial. Humanities & Sosial

Sciences Reviews, 7(6), 1112–

Atkinson, A., & Messy, F. (2012).

Measuring financial literacy:

Results of the

OECD/International Network on

Financial Education (INFE) Pilot

Study (OECD Working Papers

on Finance, Insurance and

Private Pensions, No. 15). Paris:

OECD Publishing.

Badrun, (2019), Pengaruh Literasi

Keuangan Terhadap Perilaku

Keuangan Mahasiswa Program

Studi Pendidikan Ekonomi

Universitas Pamulang November

pekobis Jurnal Pendidikan

Ekonomi Dan Bisnis 4(2):57

Doi:

32493/Pekobis.V4i2.P57-

4306

Brandl, B., & Hornuf, L. (2017).

Where did FinTechs come from,

and where do they go? The

transformation of the financial

industry in Germany after

digitalization, Working paper,

University of Jena and

University of Bremen..

Brigitta Azalea Pulo Tukan, Wahyudi

Wahyudi, Dahlia br. Pinem,

(2020) Analisis Pengaruh

Literasi Keuangan, Financial

Technology, dan Pendapatan

Terhadap Perilaku Keuangan

Dosen, Last modified: 2020-01-

/su11102990

www.mdpi.com/journal/sustaina

bility.

Chrismastianto, I. A. W. (2017).

Analisis SWOT Implementasi

Teknologi Finansial Terhadap

KualitasLlayanan Perbankan di

Indonesia, 20(1), 133–144.

Goyal Kirti, Kumar Satish (2020).

Financial literacy: A systematic

review and bibliometric analysis,

Internasional Journal Consumer

Studie Willey. Vol 2, Pp 10-22

Ion, & Alexandra. (2016). Financial

Technology (FinTech) and its

Implementation on the Romanian

Non-Banking Capital Market.

SEA –Practical Application of

Science, IV (11), 379–384

Klapper, Leora, Annamaria Lusardi,

and Georgios Panos. (2013).

?Financial Literacy and its

Consequences: Evidence from

Russia during the Financial

Crisis. Journal of Banking and

Finance 37 (10) : 3904 – 23.ence

(2)4: 162-171

Lee, I., & Shin, Y. J. (2018). Fintech:

Ecosystem, busness models,

investment decisions, and

challenges. Business Horizons,

(1), 35–46.

Lusardi A and Mitchell O S 2014 The

Economic Importancce ofFinancial Literacy: Theory and

Evidence J. Econ. Lit. vol 52 no

pp 5–44 2014

Maman Setiawan, Nury Effendi,

Teguh Santoso, Vera Intanie

Dewi, & Militcyano Samuel

Sapulette (2020): Digital

financial literacy, current

behavior of saving and spending

and its future foresight,

Economics of Innovation and

New Technology,

https://www.tandfonline.com/loi/

gein20 ,

doi.org/10.1080/10438599.2020.

Nidar,S.R., & Bestari,S.2012, Personal

Financial Literacy Among

University Students (Case Study

at Padjajaran Universitas

Students, Bandung, Indonesia).

World Journal of Social Sci

Faizah Nurul, Subhan, & Fielnanda,

Refky (2020) Pengaruh Persepsi

Kemudahan Penggunaan,

Pengetahuan Konsumen, Dan

Efektivitas Terhadap Minat

Bertransaksi Menggunakan

Financial Technology (Studi

Pada Mahasiswa Fakultas

Ekonomi Dan Bisnis Islam Uin

Sts Jambi). Skripsi thesis, UIN

Sulthan Thaha Saifuddin Jambi.

OECD. (2014). PISA 2012 technical

background. In OECD (Ed.),

PISA 2012 Results: Students and

money: Financial literacy skills

for the 21st Century (Vol. VI, pp.

–145). Paris: OECD

Publishing

Risnaningsih. (2017). Pengelolaan

Keuangan Usaha Mikro dengan

Economic Entity Concept. Jurnal

Analisa Akuntansi dan

Perpajakan, Vol 1 (1), 41-50.

Samuel Kwaku Agyei | (2018)

Culture, financial literacy, and

SME performance in Ghana,

Cogent Economics & Finance,

:1, 1463813, DOI:

1080/23322039.2018.146381

Sholeh Badrus. (2019) Pengaruh

Literasi Keuangan Terhadap

Perilaku Keuangan Mahasiswa

Program Studi

Pendidikanekonomi Universitas

Pamulang. Jurnal Pendidikan,

Ekonomi dan BisnisVol.4 No.2

Tahun2019P-ISSN: 2503 -

E-ISSN: 2686 -323557

Sugiyono. (2016). Metode

Penelitian Kuantitatif,

Kualitatif dan R&D.

Bandung: Alfabeta

Tri Ratnawati, Fatma Rohmasari, & I

Nyoman Lokajaya, (2017),

Strategi Financial Literacy &

Financial Inclusion Sebagai

Trigger Kesejahteraan

Masyarakat Industri Kecil

Kawasan Wisata Giri Kabupaten

Gresik Jawa Timur, Vol. 02, No.

, hal 57 – 64.

Downloads

Published

Issue

Section

License

The author who will publish the manuscript at DiE: Jurnal Ilmu Ekonomi dan Manajemen, agree to the following terms:

1. Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution ShareAlike License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories, pre-prints sites or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater dissemination of published work